|

Offline research is simply research by means other than electronic (e.g., personal computers, mobile devices, or tablets). This method, though can be equally as thorough, is more time consuming and requires some foot work, possibly some travel. Regardless of the preferred research method, there are advantages and disadvantages. For this reason, it will be important to do some of both. Some offline research methods include:

Offline research requires locating and making personal contact with desired and relevant sources. With this research method, you can literally reach out and touch potential customers or experts in your field or business. It does, however, take a lot of time, but depending on the type of business you are in, it is imperative. And more importantly, offline research can lead and guide you to other sources. Excerpted from, "The Start of Something BIG: Your Ultimate Guide to Writing a Dynamic Business Plan."

0 Comments

NAICS (pronounced “Nakes”), formerly known as SIC (Standard Industrial Classification), is a unique, all-new system for classifying business establishments by type of activity in which they are engaged. This system functions as part of the U.S. Department of Commerce, Bureau of the Census (www.census.gov/eos/www/naics/).

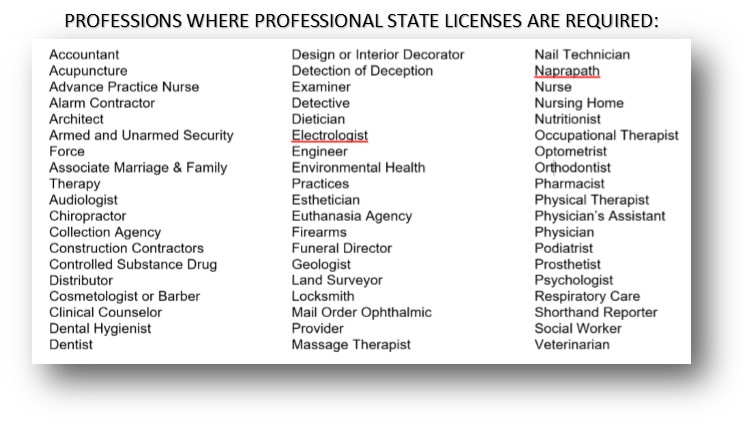

The purpose of NAICS is to facilitate the collection, tabulation, presentation and analysis of data relating to establishments and for promoting uniformity and comparability in the presentation of statistical data collected by various agencies of the federal and state governments, trade associations, and private research organizations. This is also important when filing your taxes so that your industry accounts for all the monies made under specific classifications. This information is reported, made public and lets us know how much money an industry is earning as a whole or if that industry is in a decline. NAICS reflects the structure of today’s economy in the U.S., Canada and Mexico, including the emergence and growth of the service sector and new and advanced technologies. This six-digit system, in contrast to the four-digit system of the SIC code, recognizes important industries below the level at which comparable data will be shown for all three countries. Below are the main categories for the publishing industry: Division 51 - Information 511110 Newspaper Publishers 511120 Periodical Publishers 511130 Book Publishers When conducting research for your business and its associated industry, identifying the proper NAICS codes can give you the most accurate information on how your industry is faring. This information can also prove very valuable when applying for funding for your business. It will tell you which areas throughout the US, Canada and Mexico your products and services are most consumed if at all. It may represent an opportunity for you to provide your products and services to those areas. Excerpted from, "The Start of Something BIG: Your Ultimate Guide to Writing a Dynamic Business Plan." Professional licenses are issued through the Secretary of State office in each state. This office within the state department is legislatively charged to administer and enforce specific laws relating to the licensing and regulation of certain occupations and professions. Licensure requires each applicant meet minimum standards (e.g., age, education, training certification, etc.) for their respective occupation or profession. There are 60 or more categories of licensure, and the majority of these categories include several individual license classifications. Check the Secretary of State’s office in your state for a list that may include, but not limited to, common occupations and professions that require a license: Excerpted from, "The Start of Something BIG: Your Ultimate Guide to Writing a Dynamic Business Plan."

Whether your business is located in commercial space or in your home, you should occupy space that enables you to function comfortably, professionally and efficiently. Your workspace doesn't have to be large with room to turn somersaults, but it should definitely be enough room where your legs and arms are erognomically positioned, and furniture and equipment are adequately placed and spaced. When you are not concerned with the comfort of your workspace, you are able to focus on each task at hand and be more productive.

To answer the title question, take a birdseye view of your workspace and answer the following questions. Is/does your workspace:

Evaluating your current workspace and making changes using the six items above (and others) can make performing your daily tasks much more confortable, functional and enjoyable. In addition, an efficient set-up creates an environment that brings about productivity, and some experts even say that a great workspace helps with a positive self-worth and happiness on the job. Excerpted from, "The Start of Something BIG: Your Ultimate Guide to Writing a Dynamic Business Plan." As business owners, we wear many hats. Especially the entrepreneurs who are, in fact, chief, cook and bottle washer. So, where should most of our be spent? For each entrepreneur that answer is different. Maybe you work "in" your business three days per week and "ON" your business two days per week. To make the distinction, you must understand what working "IN" versus working "ON" your business entails.

Working "IN" your business is the hands-on aspect of business which includes, but is not limited to:

On the other hand, working "ON" your business is the management of business which takes a less hands-on approach to include, but is not limited to:

All 20 of the items above and more are critical to the success of your business. Depending on the nature of your business, including seasonality of your products or services, you will need to determine when and how much you need to spend on and in your business. The formula you choose to use is yours to decide and implement. You may want to start by designating a few days a week for each or maybe a few hours per day. Either way, try to be consistent. But understand that changes in your scheduling are inevitable so it's okay to be flexible. Excerpted from the U3I, "Entrepreneurial Success Certificate Program (ESCP)." The coming in of a new year is always a good time to start something new or (as we like to say), START SOMETHING BIG. If starting a business is on your list of resolutions, then a hearty congratulations! Or, if you're already in business, it's the perfect time to re-evaluate what worked and what didn't work in your business this past year.

The first and most important aspect of starting (or growing) a business is assessing your readiness for entrepreneurship. It cannot be emphasized enough that going through this or any assessment exercise periodically (at least once a year) can be of tremendous benefit. It can help you take an honest look at where you are in your business, and even more critical, in your life, and how life and business affect each other. To begin, click on our "Assessing Your Readiness for Entrepreneurship" exercise. Answer the 18 questions as candidly and in as much detail as you can. Your responses will help you:

Join the conversation. Follow along with us in our quest to provide helpful and useful information that will help you in your business. Please feel free to share your thoughts or ask questions. Best to you and much success in your entrepreneurial endeavor. Excerpted from, "The Start of Something BIG: Your Ultimate Guide to Writing a Dynamic Business Plan." Determining the Best Legal Structure for Your Business: The Not-for-Profit (NFP) Corporation1/1/2018 A not-for-profit (or sometimes called a non-profit) is an organization that does not pass its income to its members but instead uses the income to further a goal that benefits the community. Contrary to popular belief, the not-for-profit can be profitable, and many of them are, but they may not use the profits to benefit private parties.

The most common types of not-for-profits are:

Some advantages and disadvantages of forming a not-for-profit include: Advantages

Disadvantages

To form a not-for-profit corporation, contact the Secretary of State’s office in writing or online to obtain the necessary information. For more information on the many types of not-for-profit organizations contact the Internal Revenue Service (IRS) online at https://www.irs.gov/Charities-&-Non-Profits. Excerpted from, "The Start of Something BIG: Your Ultimate Guide to Writing a Dynamic Business Plan." |

Author

Kimberly L. Johnson is an author and business development professional specializing in business start-up and business development. Archives

May 2018

|